How To Make a Will in North Carolina

Step-By-Step Guide for creating a Last Will and Testament In North Carolina

Introduction: What is a Will?

A will is an important legal document that specifies how your possessions and property will be managed and distributed after your death. It also empowers you to make key decisions, such as naming guardians to care for your minor children, ensuring their well-being and protection. Without a will, the laws of North Carolina will dictate how your estate is handled, which may not align with your personal preferences. By creating a will, you maintain control over these important choices, offering peace of mind and security for your loved ones.

Laws for Creating a Will in North Carolina

When making a will in North Carolina, you must adhere to specific legal requirements. Failing to meet these criteria could result in your will being invalid, causing complications during probate. Below are the key legal requirements for creating a Will in North Carolina:

You must be at least 18 years old.

You must be of sound mind.

This means you understand the nature of your assets, the act of creating a will, and the people you want to include as beneficiaries.

Your Will must be in written document. Oral Wills are not recognized under state law.

The Will must be signed by the testator (person making the Will), and must be signed by two competent witnesses who are present at the same time the testator signs.

Holographic wills must be entirely handwritten, signed by the testator, and proven to be in their handwriting. The “unsigned” part might confuse readers because holographic wills do require the testator’s signature.

Notarization is not required to make a Will valid in North Carolina. However, a Will can be made “self-proving” by including a notarized affidavit from the testator and witnesses.

By following North Carolina’s will laws, you can ensure your estate is distributed according to your wishes. If your will doesn’t meet these legal requirements, it could be contested or ruled invalid, leaving your estate’s distribution up to the court.

Step-by-Step:

How to Draft Your Will in North Carolina

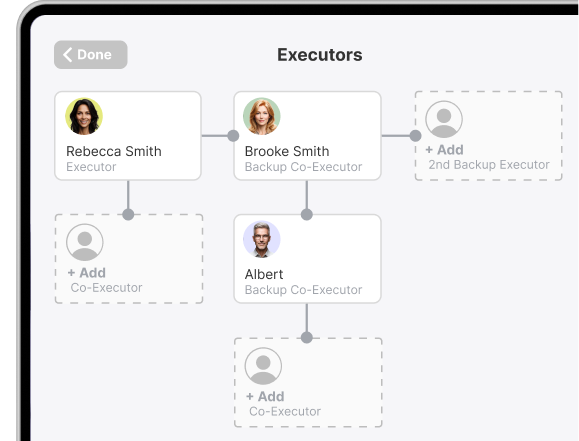

1. Choose an Executor

The executor is tasked with carrying out the instructions outlined in your will. This includes managing your estate, distributing your assets, settling any outstanding debts, and ensuring all legal processes are followed.

When choosing an executor, opt for someone dependable, organized, and trustworthy. They should have the ability to handle financial and legal matters responsibly. Many people choose close family members, trusted friends, or professional advisors for this role.

It’s also advisable to name a backup executor. This ensures someone is available to step in if your primary choice cannot fulfill their duties

.

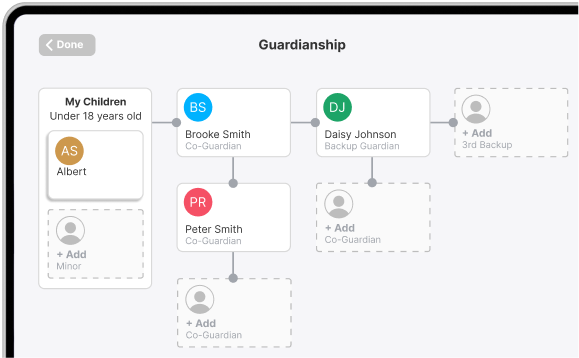

2. Appoint a Guardian for Minor Children

If you have children under 18 (or are planning to in the future), naming a guardian ensures that they will be cared for in line with your wishes. The appointed guardian will make vital decisions about their upbringing, including education, healthcare, and overall well-being.

Although naming a guardian is not legally required, it is highly recommended. Without one, a court will determine who takes care of your children, which may not align with your personal preferences.

For added security, consider designating a backup guardian. This provides a contingency plan in case your primary choice cannot fulfill their responsibilities.

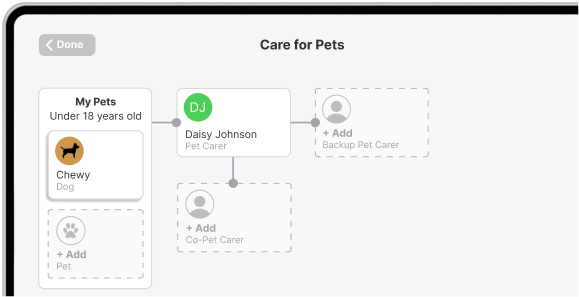

3. Name a Pet Carer

In North Carolina, you can include provisions in your will to ensure the care of your pets. Appoint someone to look after them and allocate resources for their maintenance, giving you peace of mind that they will be well cared for after you’re gone.

While optional, this step is particularly crucial for pet owners. Without a designated caretaker, the responsibility for your pets’ care falls to your executor, who may not fully understand your wishes. Naming a caretaker helps ensure your pets receive the love and care they deserve in line with your instructions.

Additionally, consider naming a backup caretaker to step in if your primary choice is unable or unwilling to take on the role.

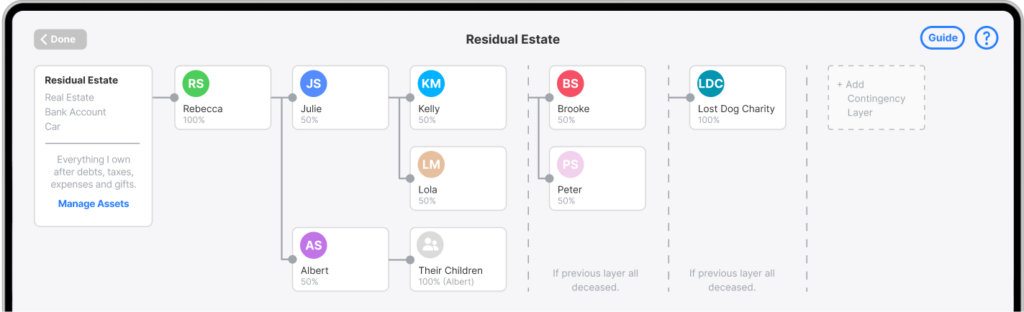

4. Decide who inherits your Residual Estate

Your residual estate includes any remaining assets left after specific bequests, debts, and expenses have been handled. You can choose one or more beneficiaries—such as family members, close friends, or charitable organizations—to inherit these assets. It’s important to clearly identify each beneficiary by their full legal name and specify the exact portion or percentage they should receive. To ensure seamless distribution, consider naming backup beneficiaries in case your primary choices are unable or unwilling to accept the inheritance.

5. Gifting Specific Items

If you wish to leave specific possessions – such as family heirlooms, jewelry, real estate, vehicles, or cash – to certain individuals, you can detail these in your will. Be as precise as possible, using clear descriptions, appraisals, or serial numbers to avoid misunderstandings or disputes. Creating an inventory of your assets beforehand is a helpful step to ensure everything is properly accounted for and your wishes are clearly communicated.

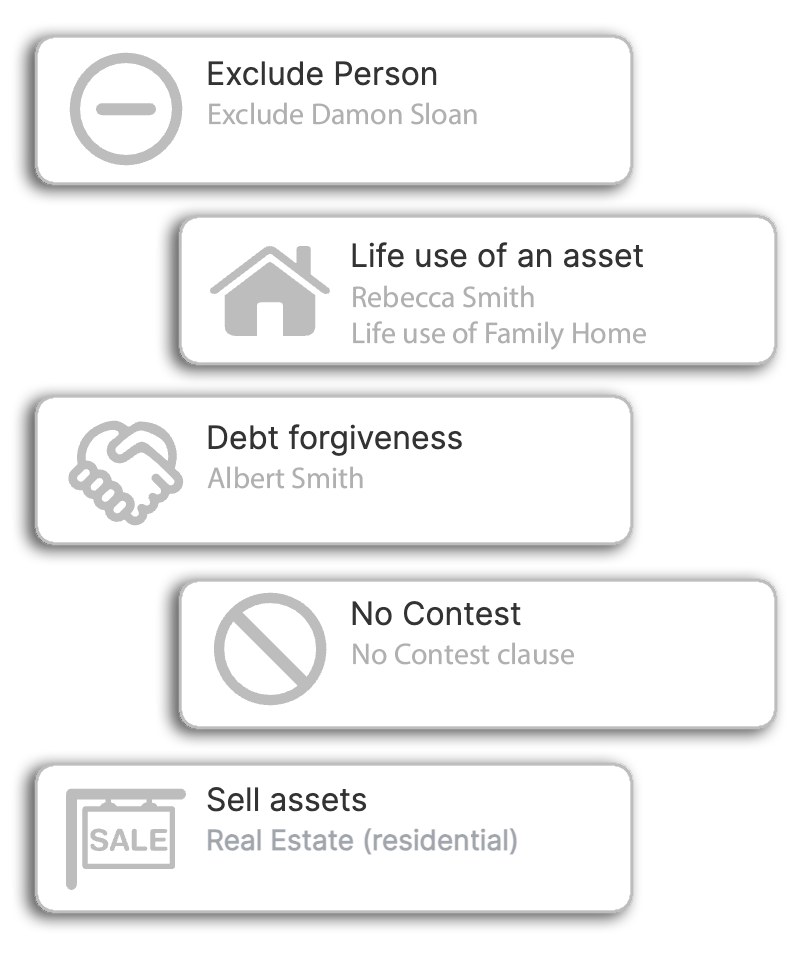

6. Any Additional Instructions or Provisions?

You may want to include additional instructions in your will, such as your preferences for burial arrangements or directions to sell particular assets. It’s also possible to make certain gifts conditional or place them in trust until beneficiaries reach a specified age. These provisions allow you to tailor your will to reflect your unique wishes and ensure they are honored.

Review Your Will

Confirming Roles in Your Will

Before completing your will in North Carolina, ensure that your selected executors, guardians, and pet caregivers fully understand their responsibilities and agree to take on these roles. This step helps prevent potential challenges during the administration of your will.

It’s also a good idea to confirm with both primary and backup individuals that they are ready to fulfill their duties if needed.

Executors

Guardians

Pet Carers

Test Your Will

Before finalizing your will, it’s important to review your decisions and account for various scenarios, such as the passing of beneficiaries or unmet conditions. This ensures that your estate is distributed according to your wishes, even in unexpected circumstances. Scenario testing helps you visualize how different changes could affect the allocation of your assets, enabling you to make well-informed decisions that align with your intentions.

Signing Your Will

Signing Your Will In Front of Witnesses

Once your will is drafted, the next critical step is printing and signing it. In North Carolina, the signing process must meet specific legal requirements for your Will to be legally valid.

Witness Requirements

To create a valid Will in North Carolina, you must sign the document in the presence of at least two witnesses. These witnesses must:

- Be at least 18 years old.

- Understand that they are witnessing the signing of your will.

- Both witnesses must sign the will after you have signed it, attesting that they were present and that you appeared to be of sound mind when signing.

Self-Proving Affidavit

To make the Will self-proving, the testator and witnesses must sign an affidavit in the presence of a notary. This eliminates the need for witness testimony in probate court.

Note: Witnesses can be named as beneficiaries in North Carolina, but this may lead to disputes, so its generally recommended to select disinterested witnesses.

Storing Your Will

Keep Your Will Safe

Once your will is signed and witnessed, it’s crucial to store the original document in a safe and secure location. In North Carolina, only the original signed copy is legally valid—digital copies cannot be used in place of the original. Losing or damaging your will may create delays and complications in carrying out your wishes.

Here are reliable options for securely storing your will:

Store at Home

Use a fireproof safe to protect your will from potential damage, and make sure your executor knows exactly where it’s stored.

With an Attorney

Many attorneys provide secure storage for original wills, often as part of their estate planning services.

Trusted Person

Consider giving your will to a dependable family member or close friend who can ensure it remains safe and accessible.

Reminder: While digital copies are useful for reference, they have no legal standing. Make sure your executor knows how to locate the original signed will to avoid unnecessary complications or delays.

FAQs: Making A Will in North Carolina

1. What Are My Options for Making a Will in North Carolina?

In North Carolina, there are several ways to create a legally valid will:

Hiring a Lawyer: This option is ideal for individuals with complex estates or unique legal needs, such as creating trusts, minimizing estate taxes, or addressing complicated family situations. An attorney can provide personalized advice and ensure your will fully complies with North Carolina’s legal requirements.

Using an Online Platform: For simpler estates, online platforms like Will Hero offer a cost-effective and guided process to draft a legally valid will. These platforms are specifically designed to ensure compliance with North Carolina’s legal requirements, making them a practical option for many individuals.

Handwritten Will (Holographic Will): A holographic will must be entirely written and signed by the testator, and the handwriting must be proven to be theirs. Witnesses are not required for holographic wills, but their validity may be challenged, especially if not stored properly or if authenticity is questioned.

2. Do I Need a Lawyer to Make a Will in North Carolina?

No, a lawyer is not required to create a valid will in North Carolina. For straightforward estates with basic instructions, you can draft the will yourself or use an online platform like Will Hero, which offers a guided and cost-effective way to ensure your will complies with North Carolina law.

However, if your estate is more complex—such as involving trusts, tax strategies, or unique family circumstances—it’s a good idea to consult an attorney. A lawyer can provide tailored guidance, address specific needs, and ensure your will is comprehensive, legally sound, and customized to your situation.

3. Are Handwritten (Holographic) Wills Valid in North Carolina?

Yes, holographic wills are valid in North Carolina if they are entirely written and signed by the testator. Unlike some other states, North Carolina does not require witnesses for holographic wills. However, proving their validity during probate can be more challenging since the handwriting must be verified as that of the testator.

While not required, having witnesses for any type of will, including handwritten ones, can make the probate process smoother and reduce the likelihood of disputes. Ensuring your will aligns with North Carolina law is key to avoiding legal complications.

4. How Much Is the Inheritance Tax in North Carolina?

North Carolina does not have an inheritance tax. This means beneficiaries who inherit property or assets from an estate are not required to pay state taxes on their inheritance. However, here are some related points to keep in mind:

Estate Tax: North Carolina also does not have an estate tax. This is a tax imposed on the value of the deceased person’s estate before it is distributed to beneficiaries.

Federal Estate Tax: While North Carolina does not impose state-level taxes, the federal estate tax may apply to estates exceeding $12.92 million in 2023 (this threshold is indexed for inflation and may change yearly). Only the portion of the estate above this threshold is taxed, and the responsibility for paying the tax falls on the estate, not the beneficiaries.

Income Tax on Inherited Assets: While inheritance itself is not taxed, beneficiaries may owe federal or state income taxes on certain types of inherited assets, such as retirement accounts (e.g., traditional IRAs or 401(k)s) when distributions are taken.

5. Do I Need to Notarize My Will in North Carolina?

No, notarization is not required for a will to be legally valid in North Carolina. However, adding a self-proving affidavit can simplify the probate process. A self-proving affidavit involves you and your witnesses signing the document in the presence of a notary. This step ensures that the witnesses won’t need to appear in court later to confirm the will’s validity. While not mandatory, notarizing your will is highly recommended to make probate more efficient and straightforward.

6. Can I Change My Will After It’s Signed?

Yes, you can modify or update your will at any time, as long as you are of sound mind. There are two main ways to do this:

- Add a Codicil: A codicil serves as a legal amendment to your existing will. It must be signed and witnessed in the same way as your original will.

- Create a New Will: Write a new will that clearly states it revokes all prior wills and codicils. Be sure to destroy any old copies to prevent confusion or disputes.

7. What Happens if I die without a Will?

If you die without a will in North Carolina, your estate will be distributed according to the state’s intestate succession laws. These laws determine how your assets are divided among your surviving relatives. Here’s what typically happens:

Intestate Succession in North Carolina:

If You Have a Spouse:

If you have no children or parents, your spouse inherits everything. If you have children, your spouse and children split the estate. The exact share depends on the number of children. If you have no children but surviving parents, your spouse and parents split the estate.If You Have Children, but No Spouse:

If you have children but no spouse, your children inherit everything. If your children are minors, a guardian or trustee may manage the inheritance until they come of age.If You Have No Spouse or Children:

Your estate goes to your parents if they are alive. If your parents are deceased, your estate is divided among your siblings.If You Have No Immediate Family:

Your estate may pass to more distant relatives such as grandparents, aunts, uncles, cousins, or their descendants.If No Relatives Can Be Found:

If no eligible relatives can be identified, your estate “escheats” to the State of North Carolina. This means the state takes ownership of your property.

Creating a Will lets you make these important decisions by yourself.

8. What is Probate?

Probate is the legal process in North Carolina through which a deceased person’s estate is administered, debts are paid, and remaining assets are distributed to heirs or beneficiaries. This process ensures that the deceased’s estate is handled according to their will (if they have one) or according to the state’s intestate succession laws (if they die without a will).

Here’s a breakdown of probate in North Carolina:

- Filing the Will:

If the deceased had a will, it must be filed with the clerk of court in the county where they resided. If no will exists, the estate is handled under North Carolina’s intestate succession laws. - Appointment of Executor/Administrator:

If the deceased had a will, the person named as the executor in the will manages the estate. If there’s no will, the court appoints an administrator to handle the estate. This is often a close family member. - Inventory of Assets:

The executor or administrator identifies and lists all the deceased’s assets, such as real estate, bank accounts, investments, and personal property. Assets must be valued to determine the total worth of the estate. - Paying Debts and Taxes: Before distributing assets, the estate’s debts (such as medical bills, loans, and funeral expenses) and taxes must be paid. This includes filing the deceased’s final income tax return.

- Distributing Assets: Once debts and taxes are settled, the remaining assets are distributed to heirs or beneficiaries as outlined in the will or according to North Carolina’s intestate laws if there is no will.

- Closing the Estate: After all debts are paid and assets are distributed, the executor or administrator files a final accounting with the court to close the estate.

Exemptions from Probate:

Some assets bypass probate entirely, such as:

- Jointly owned property with rights of survivorship.

- Life insurance proceeds and retirement accounts with designated beneficiaries.

- Payable-on-death (POD) or transfer-on-death (TOD) accounts

9. How Long Does Probate Take?

The length of probate depends on the size and complexity of the estate but generally ranges from a few months to over a year. Estates with disputes or complications may take longer.

10. Can Probate Be Avoided?

Yes, some assets in North Carolina can bypass probate through:

- Joint ownership with right of survivorship:

Assets held in joint tenancy or tenancy by the entirety automatically pass to the surviving owner(s) upon the death of one owner, avoiding probate.Example: A home owned jointly by spouses in North Carolina would transfer directly to the surviving spouse. - Beneficiary designations:

Assets such as life insurance policies, retirement accounts (e.g., IRAs, 401(k)s), and payable-on-death (POD) or transfer-on-death (TOD) accounts avoid probate if beneficiaries are named. It’s important to ensure these designations are up to date. - Revocable Living trusts:

By transferring assets into a revocable living trust, those assets pass directly to the trust’s beneficiaries without going through probate. However, it’s essential to properly title assets like real estate, bank accounts, and investments in the name of the trust. - Community Property Agreements:

Spouses in North Carolina can use a community property agreement, which allows all community property to transfer directly to the surviving spouse without probate. - Small Estate:

North Carolina provides a simplified probate process for small estates with a total value of less than $20,000 (or $30,000 if the spouse is the sole heir). In these cases, an affidavit for collection by heirs can be used to distribute assets without full probate. This can significantly reduce the time and expense involved in settling the estate. - Gifts During Lifetime:

By gifting assets to your heirs while you’re alive, you reduce the size of your estate and avoid probate for those assets. However, large gifts may be subject to federal gift tax rules.

Avoiding probate can save time, reduce costs, and maintain privacy. Probate is a public process, so keeping assets out of probate ensures that the details of your estate remain private.

While probate can’t always be avoided entirely, careful estate planning can minimize its scope and ensure that your assets are distributed more efficiently. Consulting an estate planning attorney can help you implement these strategies effectively.

Ready to Start your Will?

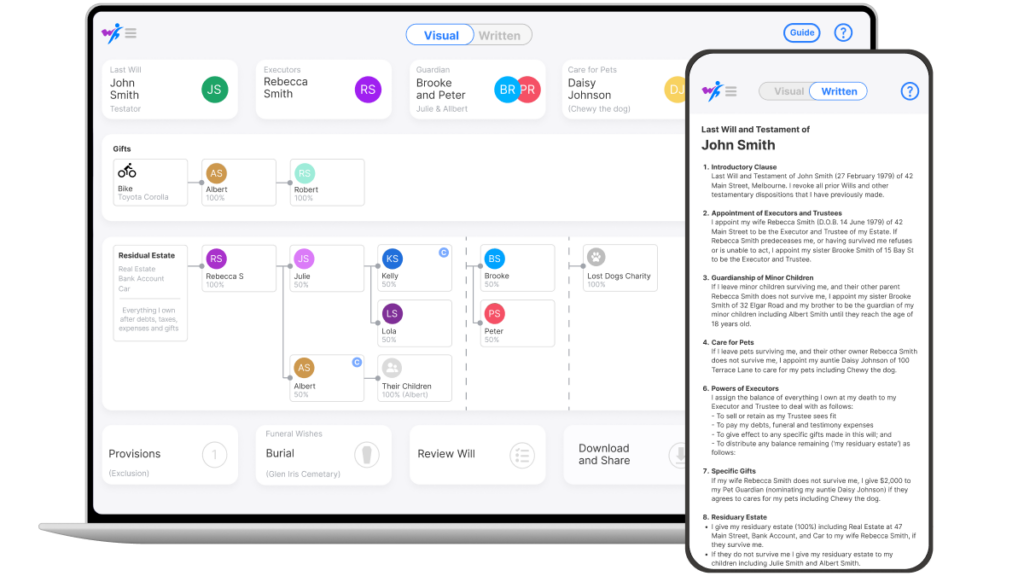

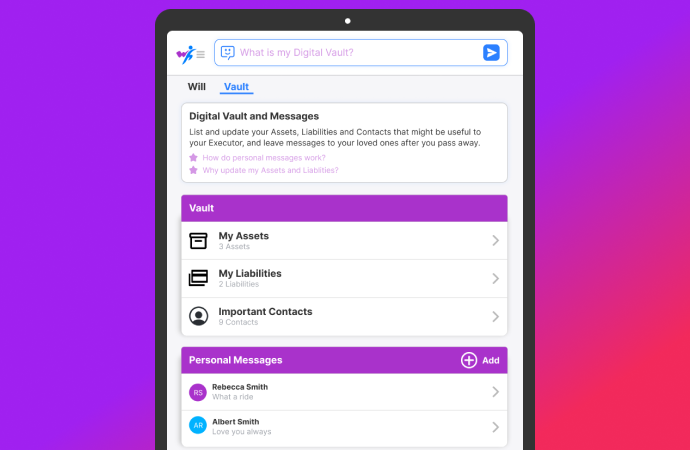

Starting your will can feel overwhelming, but Will Hero makes it simple and stress-free. Our platform offers a free, intuitive, and visual way to draft your will, clarify your wishes, and navigate estate planning with the support of expert guides and an AI Assistant. With Scenario Testing, you can ensure your will is tailored to cover different life circumstances. You’ll only need to upgrade when you’re ready to finalize your will.

At Will Hero, our mission is to make creating your will interactive, visual, and even fun. Take the first step today to secure your legacy and bring peace of mind to your loved ones!