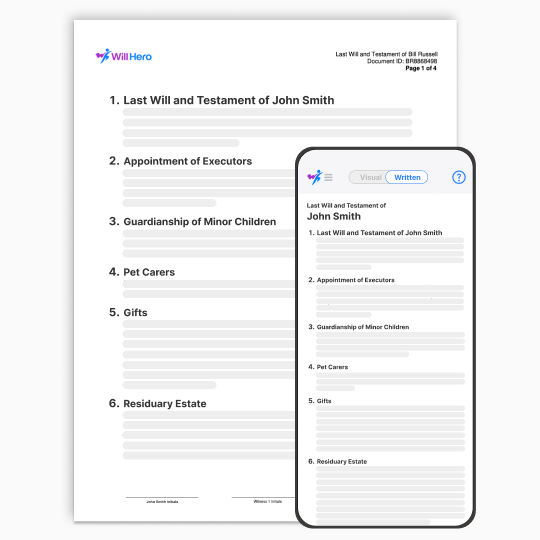

How To Make a Will in California

A Step-By-Step Guide for creating a Last Will and Testament In California

Introduction: What is a Will?

A Will is an important document that determines how your property is distributed after death. It’s also a way to make crucial decisions about your family’s future. Beyond passing on assets like property and money, a will allows you to name guardians for your minor children, ensuring their well-being if something happens to you. Without a will, the state of California will decide how your estate is divided, which may not align with your desires.

Laws for Creating a Will in California

When making a will in California, you must adhere to specific legal requirements. Failing to meet these criteria could result in your will being invalid, causing complications during probate. Below are the key legal requirements in California:

You must be at least 18 years old.

You must be of sound mind:

This means you understand what a Will is, what your assets are, and how you are distributing them.

The Will must be in writing:

Oral Wills are not recognized in California, so your Will must be a physical document (either typed or handwritten). Your Will must be signed by you and two competent witnesses.

By following California’s will laws, you can ensure your estate is distributed as you intend. If your will doesn’t meet these requirements, it may be contested or deemed invalid, potentially leaving the fate of your estate to the courts.

Step-by-Step:

How to Draft Your Will in California

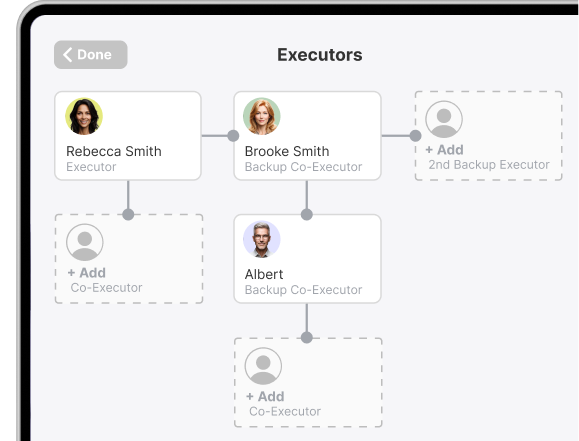

1. Choose an Executor

An executor is the person responsible for carrying out your will and managing your estate after you pass away. They will ensure that your assets are distributed according to your wishes, pay any outstanding debts, and handle the legal steps required to settle your estate.

When choosing an executor, consider someone who is organized, trustworthy, and capable of managing the responsibilities. Most people select a family member, close friend, or professional advisor.

It’s wise to name a backup executor in case your first choice is unable or unwilling to serve.

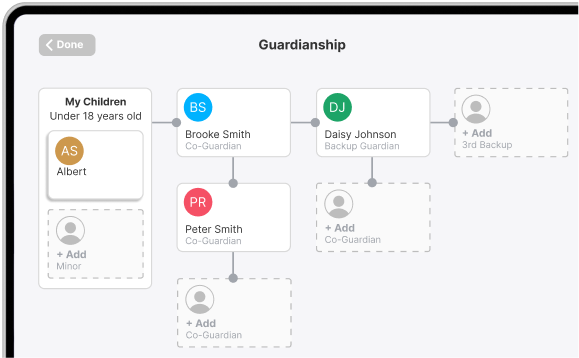

2. Name a Guardian for Minor Children

If you have minor children, you’ll want to name a guardian to care for them in the event of your death. The guardian you choose will be responsible for their upbringing, including making decisions about their education, healthcare, and overall well-being.

While this step is optional, it’s an important consideration for parents. In California, if you don’t name a guardian, the court will appoint one, which might not align with your preferences.

It’s wise to name a backup guardian in case your first choice is unable or unwilling to serve.

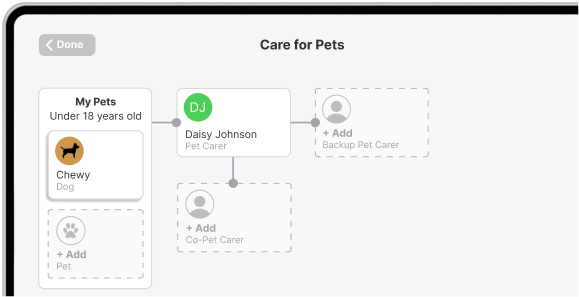

3. Name a Pet Carer

California’s law allows you the option to include provisions for the care of your pets in your will. You can name someone to care for your pets and allocate resources for their upkeep. This ensures your furry friends are well taken care of even when you’re no longer around.

This step is optional, it’s an important consideration for your furry loved ones. In California, if you don’t name a pet carer or pet guardian, this decision will be left to your Executor.

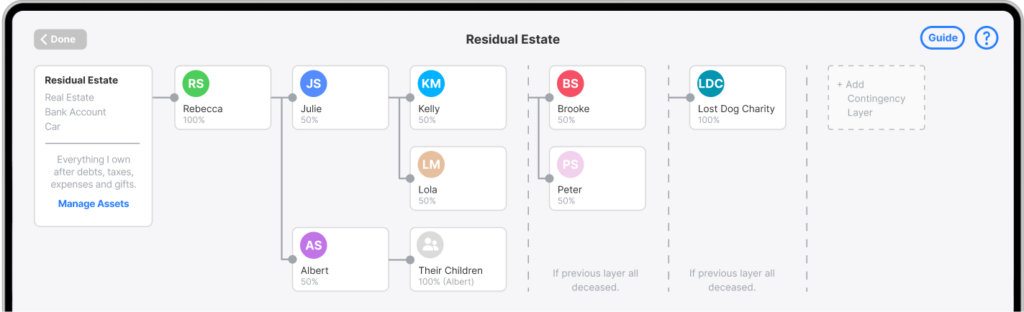

4. Decide who inherits your Residual Estate

The residual estate is what remains after any specific gifts or expenses are deducted. You can choose one or more beneficiaries, such as family members, friends, or even charitable organizations, to receive your remaining assets. Make sure to clearly list their full names and indicate the proportion each should receive. It’s also best practice to name backup beneficiaries.

5. Gifting Specific Items

If you have specific items—such as a family heirloom, a piece of jewelry, or a property—that you wish to give to a particular person, you can designate these in your will. Be as detailed as possible to avoid any confusion or disputes later. It’s best practice to take stock of all your assets before drafting your Will.

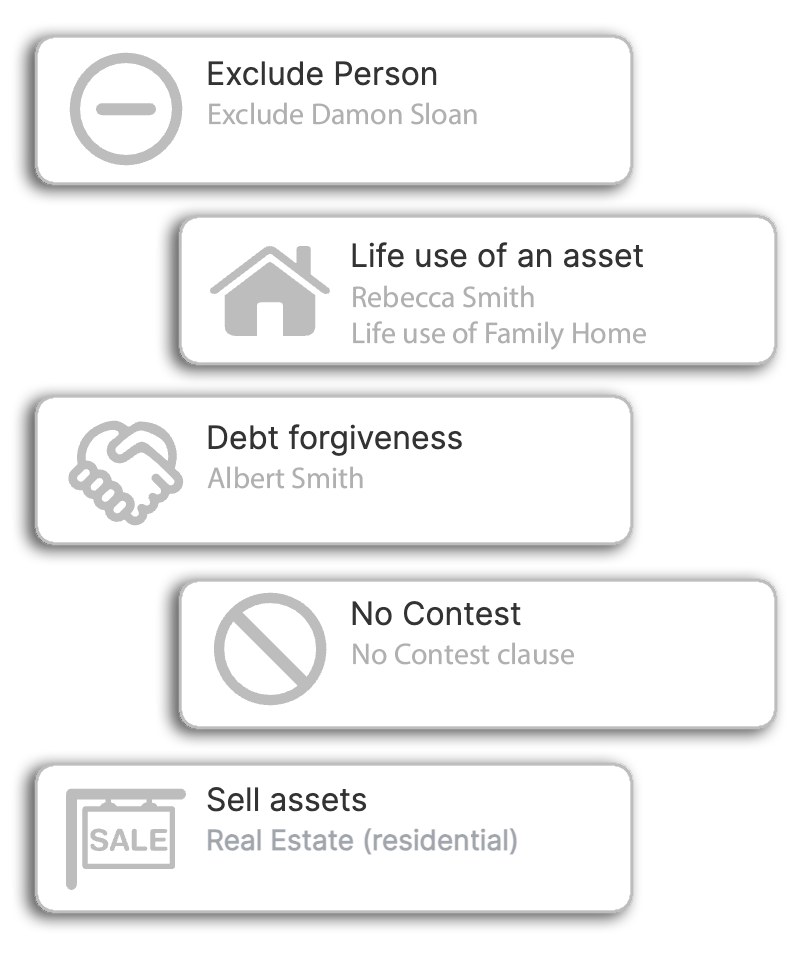

6. Any Additional Instructions or Provisions?

It’s optional to include special instructions, such as how you’d like your funeral to be conducted or instructions to sell an asset. You might also wish make a gift conditional, or leave a fund in trust until beneficiaries reach a certain age.

Review Your Will

Confirming Roles in Your Will

Before finalizing your Will in California, it’s essential to confirm that your chosen Executors, Guardians and Pet Carers are willing to undertake their designated roles. This confirmation ensure that each individual is prepared and agrees to fulfill their responsibilities, minimizing potential complications in executing your Will.

It is best practice to confirm with the people nominated in the roles below, along with their backups that they are agree to take on this responsibility:

Executors

Guardians

Pet Carers

Test Your Will

Before you complete your Will, it’s important you think through your wishes and see if you have planned for different potential scenarios, such as people in your Will passing away before you, or conditions not being met.

Signing Your Will

Signing Your Will In Front of Witnesses

Once your will is drafted, the next critical step is printing and signing it. In California, the signing process must meet specific legal requirements for the will to be valid.

Witness Requirements

In California, you must sign your will in the presence of at least two witnesses. These witnesses must:

- Be at least 18 years old.

- Not be named as beneficiaries in the will, to avoid any potential conflict of interest.

- Understand that they are witnessing the signing of your will.

Both witnesses must also sign the will after you have signed it, attesting that they were present and that you appeared to be of sound mind when signing.

Witnesses vs Notaries

While a will does not need to be notarized in California to be legally binding, some people opt to have their will notarized to create a “self-proving” will. A self-proving will can help expedite probate, as the court can accept the document as authentic without needing the witnesses to testify. However, the notarization process is optional and not required by law.

Storing Your Will

Keep Your Will Safe

After your will has been signed and witnessed, it’s essential to store the original document in a safe place. In California, the legally binding version of your will must be the original signed copy, not a digital version. Losing or damaging this document could cause complications for your loved ones and delay the distribution of your assets.

Here are some options for storing your will securely:

Store at Home

You can also leave your will in the care of a trusted family member or friend, making sure they understand the importance of safeguarding the document.

With an Attorney

If you worked with a lawyer to create your will, they may offer to store the original document for you in a secure location.

Trusted Person

You can also leave your will in the care of a trusted family member or friend, making sure they understand the importance of safeguarding the document.

While it’s possible to store documents online for easy reference, please remember that only the original signed document is legally valid. It is best practice to ensure your executor knows where to find the physical copy to avoid any legal complications.

FAQs: California's Wills

1. What Are My Options for Making a Will in California?

In California, you have several options for creating a will:

- Hiring a Lawyer: If you have a large or complex estate, or if you want personalized legal advice, hiring an attorney may be the best choice. They can help with estate tax planning, trusts, and any other specialized needs.

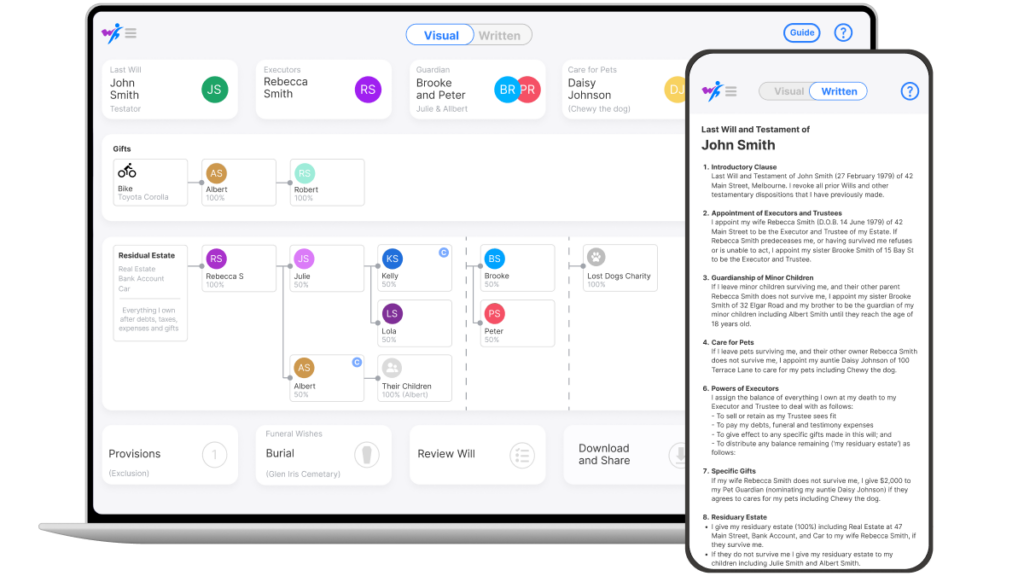

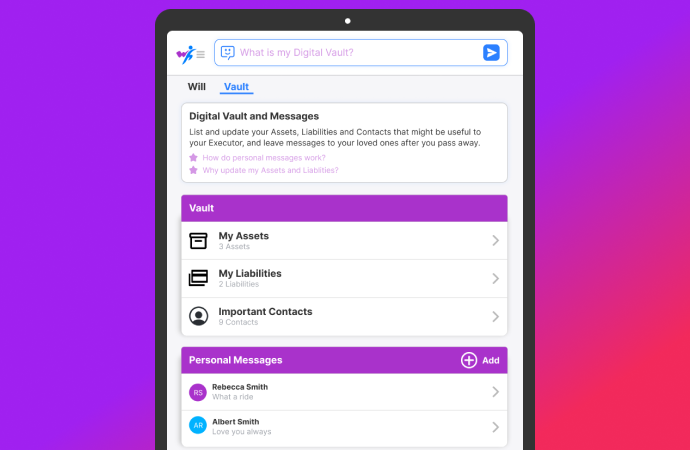

- Using an Online Platform: For straightforward estates, platforms like Will Hero provide an affordable and convenient way to create a legally valid will. Our visual interface simplifies the process, guiding you step-by-step to ensure all important aspects are covered.

- Handwritten Will (Holographic Will): California allows handwritten (or “holographic”) wills as long as they are signed and dated by the person making the will. However, these wills can be more easily contested in court, as they often lack witnesses or clear language.

2. Do I Need a Lawyer to Make a Will in California?

No, you are not required to hire a lawyer to create a valid will in California. If your estate is simple and your wishes are straightforward, you can create a will using an online platform or even a handwritten will. However, if your estate is complex or you have specific concerns about tax planning or trusts, seeking legal advice may be beneficial.

3. Are Handwritten (Holographic) Wills Valid in California?

Yes, handwritten wills, also known as holographic wills, are valid in California. To be considered legally binding, the entire will must be written in your own handwriting and must be signed and dated. However, holographic wills are more likely to be contested in court, especially if the instructions are unclear or if there are disputes among beneficiaries. For greater security, a typed will with witnesses is recommended.

4. How Much Is the Inheritance Tax in California?

California does not have a state inheritance tax, but the federal estate tax may apply to estates exceeding the federal exemption threshold, which is currently $12.92 million (as of 2023). Estates valued below this threshold will not owe federal estate taxes. If your estate is larger than the federal limit, it may be subject to federal taxes. It’s wise to consult a tax professional or an attorney if you’re concerned about estate taxes.

5. Do I Need to Notarize My Will in California?

No, California does not require wills to be notarized to be legally valid. However, you must have at least two witnesses who are present when you sign your will, and these witnesses must also sign the will. While notarizing a will can create a “self-proving” document that might expedite the probate process, it is not a requirement under Californian law.

6. Can I Change My Will After It’s Signed?

Yes, you can change or update your will at any time, as long as you are of sound mind. There are two main ways to do this:

- Add a Codicil: A codicil is a legal amendment to your existing will. It must be signed and witnessed in the same way as your original will.

- Create a New Will: You can draft a new will to replace your old one. Be sure to explicitly state in the new document that it revokes all prior wills and codicils. After signing the new will, destroy all copies of the old one to avoid any confusion or disputes.

7. What Happens if I die without a Will?

If you die without a will in California, your estate will be distributed according to the state’s intestate succession laws. This means your assets will go to your closest relatives, as determined by law. If you have no close relatives, the state may take possession of your property. Additionally, if you have minor children, the court will decide who will become their guardian, which may not align with your wishes. Having a will allows you to control these important decisions.

8. What is Probate?

Probate is the legal process that takes place after someone dies to ensure their will is valid and their estate is distributed according to their wishes (or according to state law if there’s no will).

In California, probate generally involves the following steps:

Filing the Will: After someone passes away, their will must be filed with the local probate court, along with a petition to open probate. If there’s no will, a petition for intestate succession is filed instead.

Appointment of an Executor: If a will exists, the executor named in the document will be appointed to oversee the estate. If no executor is named, the court will appoint one. If there’s no will, the court will appoint an administrator to handle the estate.

Inventory of Assets: The executor is responsible for identifying and valuing the deceased person’s assets. This includes property, bank accounts, investments, personal belongings, and any debts owed.

Paying Debts and Taxes: Before distributing the estate to beneficiaries, the executor must ensure all outstanding debts, taxes, and expenses are paid. This may include mortgages, credit card bills, medical expenses, and estate taxes, if applicable.

Distribution of the Estate: Once debts and expenses are paid, the remaining assets are distributed to the beneficiaries named in the will. If there’s no will, the assets are distributed according to California’s intestate succession laws.

Closing the Estate: After the assets have been distributed and all obligations are met, the executor will file a final petition with the court to close the probate process.

9. How Long Does Probate Take?

The probate process in California can take anywhere from several months to a few years, depending on the complexity of the estate, any disputes among beneficiaries, and whether or not the will is contested. On average, probate takes about 9-18 months to complete.

10. Can Probate Be Avoided?

Some assets can bypass probate through mechanisms like:

- Joint ownership with right of survivorship: For example, property held in joint tenancy will automatically pass to the surviving owner.

- Beneficiary designations: Assets like life insurance policies, retirement accounts, and payable-on-death accounts with designated beneficiaries don’t need to go through probate.

- Living trusts: A living trust allows you to transfer ownership of your assets into the trust while you’re alive. The trust then holds those assets for your benefit during your lifetime and transfers them to your designated beneficiaries after your death. Since the assets are owned by the trust, not by you personally, they don’t need to go through probate. It’s important to ensure that your assets, such as real estate, bank accounts, and investments, are properly moved into the trust for this benefit to apply.

Ready to Start your Will?

For many, just getting started is the hardest part. If you need to help taking the first step then why not try Will Hero? It’s free to get started and draft a Will visually, see and understand what you want your wishes to be, become educated about Wills and estate planning with guides and our AI Assistant. You can also test your Will under different potential circumstances with a free account using Scenario Testing. Only when you are happy with your Will and wish to review the written document is an Upgrade required. Will Hero is on a quest to make Will creation more visual, interactive and even fun, as opposed to difficult and daunting.

However you wish to make your Will, get started today and protect your loved ones and your legacy.